What is Negative Equity?

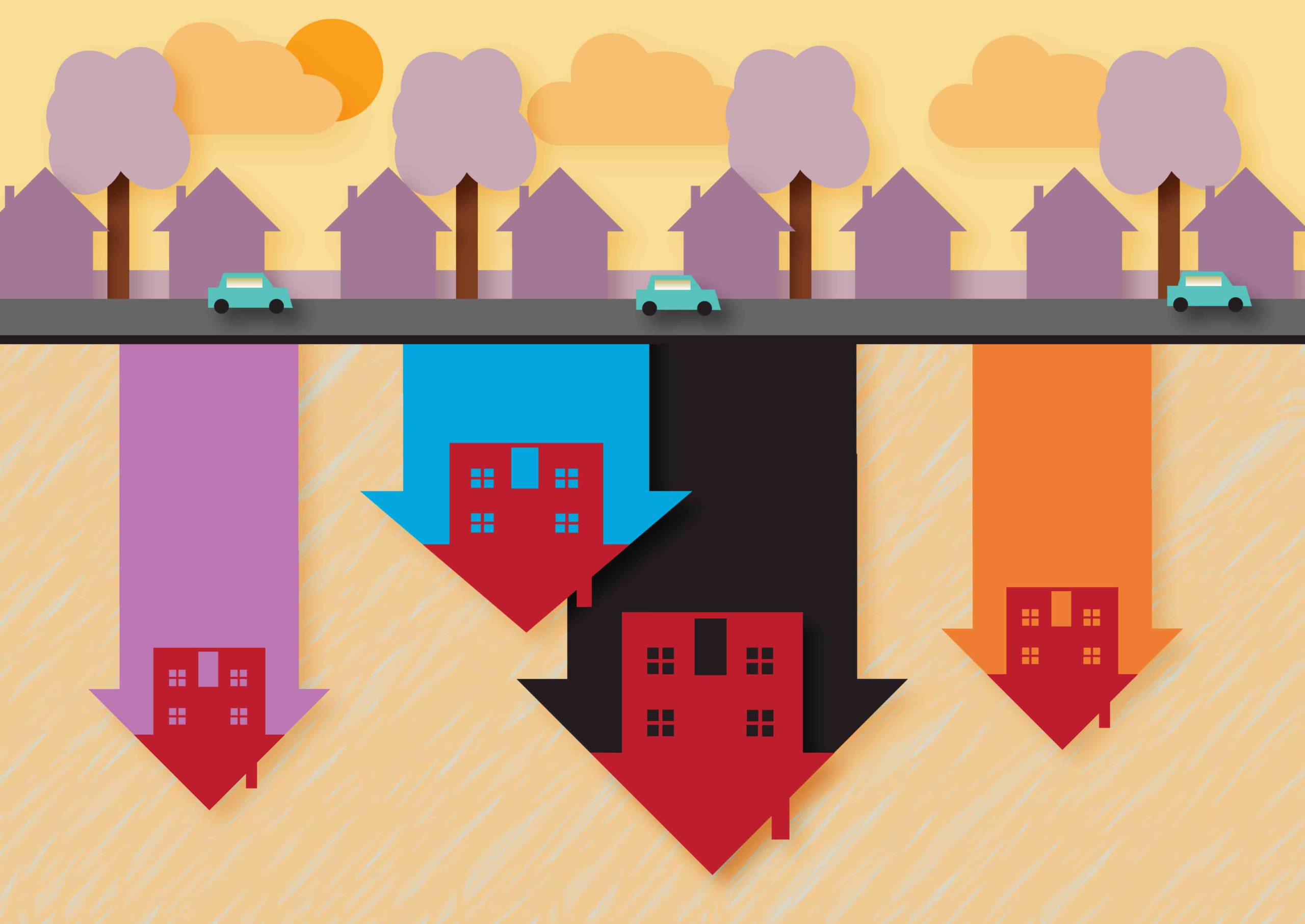

What is negative equity? A property is in ‘negative equity’ if it’s worth less than the outstanding mortgage on it. For example, if you owe £150,000 on your mortgage and your home is worth £100,000, you’d be in £50,000 negative equity.

Being in negative equity isn’t always a problem – but it can make it difficult to remortgage or move house.

Am I in negative equity?

Check your mortgage statement or call your lender to find out how much you owe on your mortgage. Then ask a local estate agent to value your home, or check its value online.

If your mortgage balance is more than your home is worth, you are in negative equity.

If your home is worth more than you owe, you are said to have equity in your home or be in ‘positive equity’.

How do you get into negative equity?

Falling house prices are the most common reason for negative equity.

So, what is negative equity? For example, say you bought a £200,000 property with a 5% (£10,000) deposit and a £190,000 mortgage. If in a few years’ time, the property was only worth £180,000 you’d be in negative equity.

The risk of falling into negative equity is higher if you only put down a small deposit when you buy the property. This is because there is less leeway for house price movements.

How much you borrow as a mortgage in relation to the property’s value is known as the loan-to-value (LTV).

If you have positive equity in your property, you might be tempted to secure other debts against your home. But this is risky as it will increase your total LTV. It also means your home could be repossessed if you fail to pay the other debts.

Borrowers who pay their mortgage on an interest-only basis are at higher risk. This is because the monthly payments only pay the interest on the loan, not part of the capital too. Paying off the capital on your mortgage reduces the risk of negative equity.

What’s the problem with being in negative equity?

Negative equity often doesn’t matter, in the short term at least. If you can afford your mortgage payments and don’t need to sell, move home, or remortgage, then negative equity isn’t really an issue.

But it becomes a problem if you want to remortgage or sell your home.

When you remortgage, mortgage lenders won’t lend more than the value of your home. So, if you want to remortgage a £200,000 home loan, but your property is only worth £180,000, you won’t be able to get a new mortgage.

When you sell a home, you normally need the sale price to be enough to pay off your outstanding mortgage. If the sale price is less than you owe, you’ll need cash to pay off the shortfall. If you can’t afford to do this, selling or using equity as a deposit for moving house can be very difficult.

How can I avoid it?

When you buy a property, think about what house prices are likely to do in that area. Improved transport links or regeneration projects are likely to boost house prices. But a motorway being built at the end of your garden is likely to have the opposite effect.

When you buy your home, put down as big a deposit as you can. This will mean you borrow at a lower LTV. Pay your mortgage on a repayment basis and, if your mortgage allows it, make overpayments whenever you can.

Keep your home well maintained and, if possible, make improvements that will boost its value.

What to do if you’re in negative equity

If you don’t need to remortgage or move house, you don’t need to do anything about negative equity. Simply sit tight and wait for the housing market in your area to improve.

If you need to remortgage or sell, use any cash savings or investments to reduce the amount you owe on your mortgage.

If you can’t remortgage, it doesn’t mean you’ll lose your home. When a fixed rate ends, you’ll normally be moved to your lender’s standard variable rate (SVR). This is likely to be higher, so your payments will be more. If you can’t afford your new payment, talk to your mortgage lender. It might allow you to extend the term of your mortgage, which will mean cheaper monthly payments.

If you want to sell while you’re in negative equity, but don’t have the cash to make up the shortfall, moving home will be difficult. However, some lenders will allow you to sell your home and then pay off any shortfall over a period of time.

Need to speak to a mortgage advisor?

We can connect you with our approved mortgage adviser. They can explore your mortgage options and can advise you based on your circumstances. You may be able to find a deal that suits you better than with your current lender. Get a mortgage quote below.

Trussle is offering fee-free advice and have access to over 12,000 deals from 90 lenders!

Your home may be repossessed if you do not keep up repayments on your mortgage.

Last Updated: November 1st, 2024